Welcome to

Energy Environmental Corporation

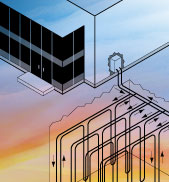

The Standard for Net Zero™ Radiant Floor Cooling and Heating with Heat Pumps

Our mission is to help create a socially and environmentally sustainable world, by leading others in creating technology solutions inspired by passionate ideas, genuine encouragement, and teamwork.

Our mission is to help create a socially and environmentally sustainable world, by leading others in creating technology solutions inspired by passionate ideas, genuine encouragement, and teamwork.

For two decades, Energy Environmental Corporation (EEC) has set The Standard for Net Zero™ solutions using HVAC and Renewable Energy Systems in low energy and no carbon footprint sustainable buildings. Dozens of commercial net zero™ energy low carbon buildings use our patented technologies with modular systems combining solar, geothermal, snow melt, and radiant in-floor heating and cooling with reliable simple-to-operate controls for superior comfort, indoor air quality, and energy efficiency. EEC has developed manufacturing methods for our SimplyRadiant™ radiant panels and geothermal pumping which provide high reliability at a reasonable cost for installations throughout the United States. EEC is a Master Dealer for WaterFurnace, a technology market leader for residential geothermal heat pumps. EEC is a service-disabled veteran-owned small business who works with residential homeowners and commercial building owners to provide affordable planet-friendly solutions that provide outstanding comfort, energy efficiency and indoor air quality with a low carbon footprint.

At EEC, we understand that high performance at a reasonable cost is achievable. We believe that green components integrated as a total architecture far surpass the energy and financial performance of standalone installations. We have created a successful practice for sustainable living and environmentally friendly systems with a focus on energy savings and the health, comfort, and safety of the occupants. A prerequisite to our design engagements is working with our clients to provide financial justification for their investment. In most cases, the overall investment, including the cost of our services, is cash flow positive when compared to conventional systems. Please visit our Products and Services and System Pricing pages for more details.

We are committed to overcoming market obstacles that prevent the implementation of green technology through consumer and design professionals education, contractor training, and cost-effective implementation of our sustainable designs. Energy Environmental has invested heavily toward this goal by developing a test bed and demonstration home in Colorado. By “practicing what we preach”, we are able to push the building envelope for systems integration to deliver superior reliability and performance at affordable price points. Information on this project is disseminated online at www.platinumLEEDhome.com.

The following patents and pending applications are applicable to Energy Environmental Corporation (EEC) technologies:

- U.S. Patent 9,410,752 Aug 9, 2016

- U.S. Patent 10,072,863 Sep 11, 2018

- U.S. Patent 10,330,336 June 25, 2019

- U.S. Patent 10,907,848 Feb 2, 2021

- U.S. Patent 11,287,152 Mar 29, 2022

- U.S. Patent 11,664,214 May 9, 2023

- U.S. Patent 11,796,210 October 24, 2023

- 8th Patent Pending Application 18/242362 dated September 5, 2023

The following trademarks of Energy Environmental Corporation (EEC) are pending in the U.S. Patent and Trademark Office:

- Energy Environmental Corporation™ with associated graphic

- RFC™

- Simply Radiant™

- The Standard for Net Zero™

To contact us regarding DESIGN SERVICES or SIMPLY RADIANT® PRODUCT INFORMATION, please call (303-877-5776) or email us at sue@EnergyHomes.org.